We have been trained by the credit industry to equate the contents of our credit report with our credit worthiness.

The two are not the same.

A credit report may show that you have faithfully made every payment on time for your entire life and still you are not worthy of more credit because you can’t ever pay off the credit you have.

On the other hand, you may be a good credit risk despite a credit report with an ugly history, because you have a solid financial situation today.

What is a credit report

A credit report is a history.

Under federal law, you are entitled to an accurate history, but not to a re writing of truthful history. That history can properly include delinquencies or bankruptcy.

So, the fact that you had delinquent debt that was discharged in bankruptcy doesn’t vanish from your credit report.

A credit report also uses special terms such as “charged off”, borrowed from accounting.

The notation that a debt is charged off does not necessarily mean it is not legally enforceable.

“Charge off” indicates that the creditor doesn’t expect to collect the debt; a charge off alters the creditor’s income for tax purposes. It is also a benchmark for how long old debt can appear on your credit report.

It does not relieve the debtor of legal liability for its payment.

Your credit report is not a reliable guide to everyone you may owe money to. Not all creditors report to credit reporting agencies; your credit report lists only those that do report and the contents of the public record.

Credit reports after bankruptcy

A bankruptcy discharge will not erase discharged creditors or your pre bankruptcy payment history. Accurate history can still be reported.

But, and most importantly, after a bankruptcy discharge, the amount outstanding for each discharged account should be shown as zero.

FTC OSC section 607, item 6 states: “A consumer report may include an account that was discharged in bankruptcy (as well as the bankruptcy itself), as long as it reports a zero balance due to reflect the fact that the consumer is no longer liable for the discharged debt.

So, after the discharge, you are entitled under federal law to have the balance of each discharged debt reported as “O”. The history of delinquencies can be reported, but the balance must be zero.

If it is not so reported, dispute the debt.

Your bankruptcy can be reported on your credit report for 10 years from the filing of the case. If you file a bankruptcy and voluntarily dismiss it before the discharge, the credit reporting agency must report the dismissal as well as the bankruptcy filing.

The creditors you continue to pay after bankruptcy may not report your payments unless you elected to reaffirm the debt and got court approval to do so.

Creditworthiness after bankruptcy

Assuming you have income, you should be more credit worthy after a bankruptcy than you were before, since your old debts no longer have a claim on your future income.

Negative history on your credit report is just that: history. It does not doom you to perpetual credit rejection. It does challenge you to strengthen your financial present by saving and using credit carefully.

Fixing your credit report

You don’t need to hire anyone to see that errors in your credit report are corrected or positive information is reported.

In fact, many credit repair offers are scams that, at best, waste your money and, at worst, involve you in a crime.

Under the Fair Credit Reporting Act, you can challenge information that you believe is inaccurate. If the reporting agency can’t verify the accuracy of the information, they must remove it.

If you have received a discharge in bankruptcy, it is in your interest to have the discharge noted on your report, since it is proof that the old debt is no longer legally enforceable.

Consumers are entitled to a free credit report annually from each of the major reporting agencies. Access that free credit report.

Avoid the outfits that use “free credit report” in their name and their jingle, but charge you for something else in the process.

Credit reporting agencies often give short shift to consumer challenges to the accuracy of their report. If their “verification” of the challenged entry claims to support the accuracy of the entry, then you may need a lawyer familiar with the Fair Credit Reporting Act for redress.

Continue to monitor your report; we’ve seen cases where debt discharged in bankruptcy three or four years ago reappears in the hands of a new creditor. The credit report claims it is a current, and delinquent debt, despite the bankruptcy.

Read more

Creditors who call after you’ve gotten your bankruptcy discharge

How to pick a bankruptcy lawyer

Pitfalls in filing bankruptcy without a lawyer

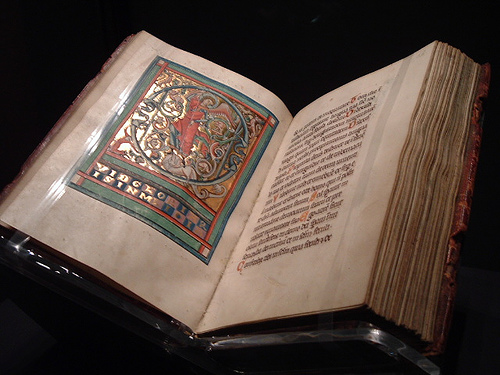

Image courtesy of Flickr and Clio1789