Strange things happen to community property in bankruptcy.

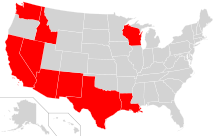

Community property is a system of marital property ownership found in nine U.S. states.

The basic premise of community property is that assets acquired during marriage are presumed to be community property, owned equally by the spouses, regardless of which spouse earned it.

Usually, property owned before marriage, acquired by gift, or by inheritance by one spouse is that spouse’s separate property.

The spouses can agree to hold property differently than the community property presumption. They can also transmute community property into some other form of ownership.

California has enacted very specific rules on transmutation.

The state’s marital property scheme makes a difference in bankruptcy, a federal law, because bankruptcy generally looks to state law to define the character of property. And the character of property determines which creditors have a claim on that property.

The other, often unanticipated wrinkle is that Bankruptcy Code 541 provides that all of the community property is part of the bankruptcy estate, even if only one spouse files.

Form matters in California

California bankruptcy cases used to hold that real property held in joint tenancy is the separate property of the spouses, each spouse holding their interest in the joint tenancy as their separate property. Years of law was upset by the Brace decision that says that the acquisition during marriage trumps the form of title. So, joint tenancy property held by spouses may actually be community property. More on Brace.

So, when one spouse files a bankruptcy case, the form of title, community or separate, makes a significant difference. If it’s community property, the entire property comes into the estate for administration.

If it’s separate property, only the filer’s share of an asset is available to creditors in the bankruptcy case.

Read more

How bankruptcy is different in California

File bankruptcy without your spouse

Image courtesy of Wikimedia.